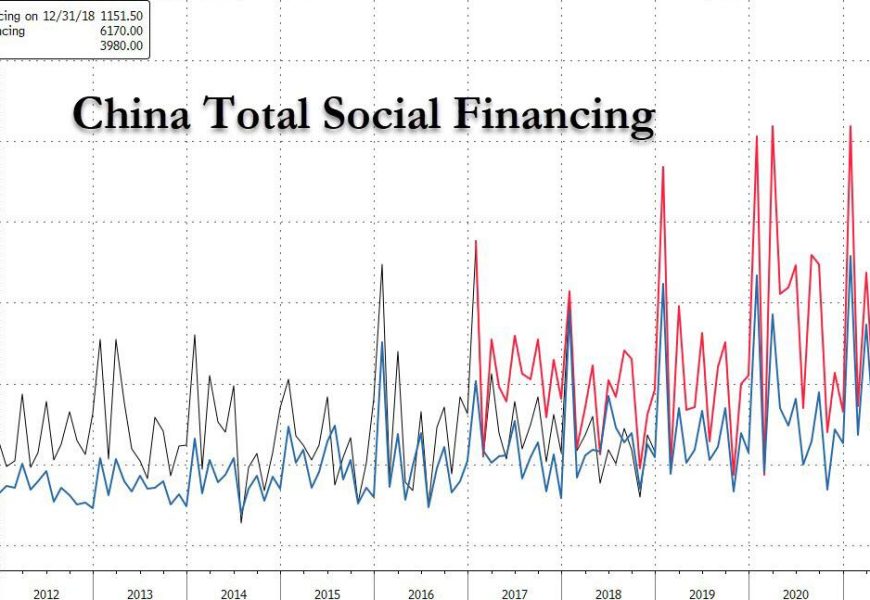

China Injects $1 Trillion In Biggest Monthly Credit Surge On Record

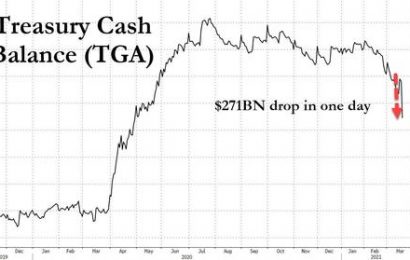

While Wall Street is being torn apart by fierce debate whether the upcoming “six or seven” in rate hikes coupled with $2.5 trillion in QT over the next two years will blow up US capital markets, overnight China showed how...