Von Greyerz: Some numbers about the massive money creation

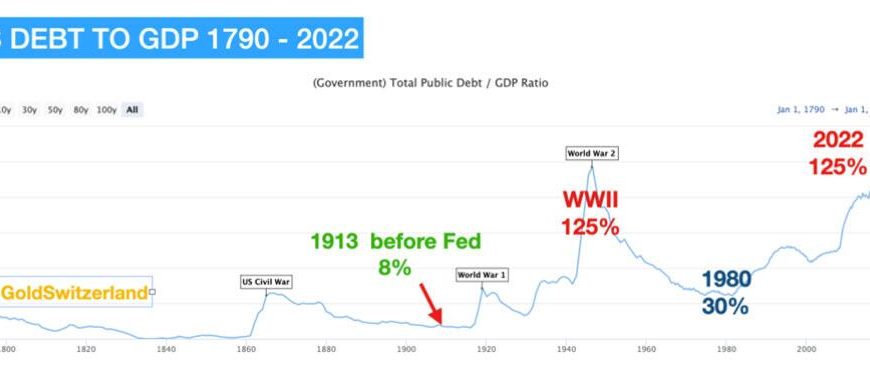

The massive money creation by central and commercial banks in this century has resulted in a growth of global assets from $450 trillion in 2000 to $1,540 trillion in 2020. Debt To GDP Growth As the chart below shows US...