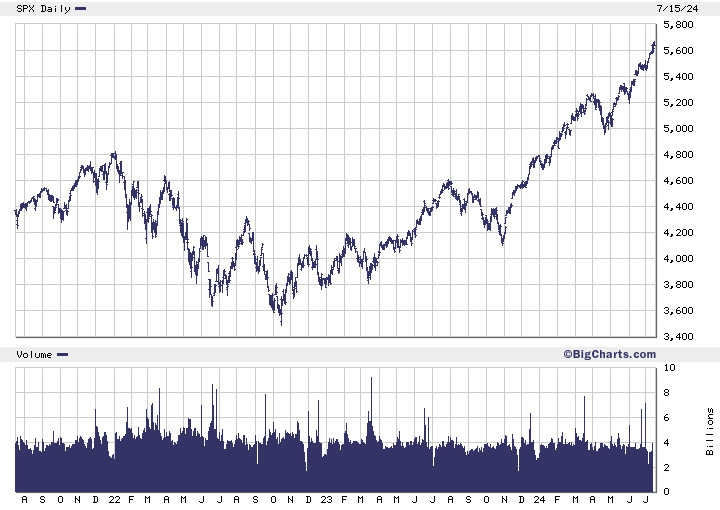

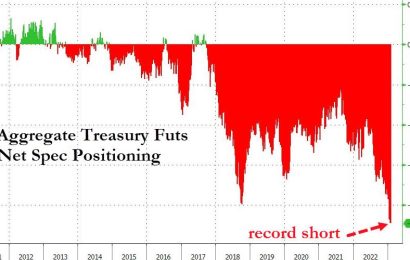

Risk Warning: Very High Probability of Decline in Capital Markets

As has been my standard since September 1998, I again publicly warn in advance of the increased risk of a decline in capital markets. – Generally, stocks are overpriced again (especially in tech) – Valuation of shares not corresponding to...