Head Of NY Fed’s Trading Desk: “Fed’s Purchases May Stop Entirely”

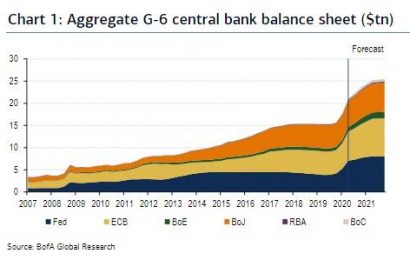

Head Of NY Fed’s Trading Desk Says If Markets Continue Improving, Fed’s Purchases May Stop Entirely. Stocks have gone nowhere since the Fed’s balance sheet started shrinking modestly in mid-June. This morning, Miller Tabak picked up on this observations, writing that “Maybe we’re wrong. ...