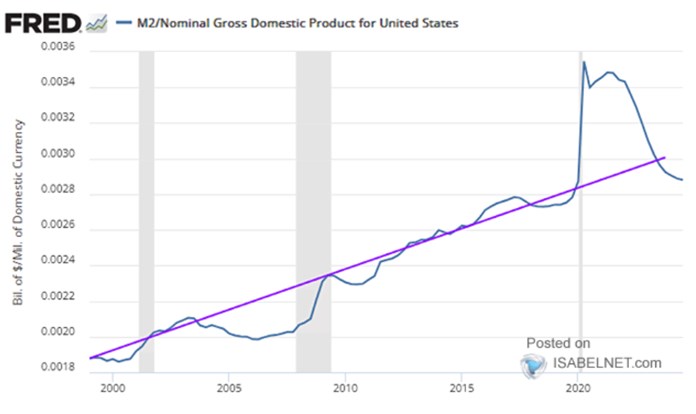

M2 money supply in the US continues to decline

The chart from FRED shows the ratio of M2 to the nominal product of the US economy. It also shows the trend, where the correlation was visible especially after the Global Financial Crisis until 2020. After this period, the money...