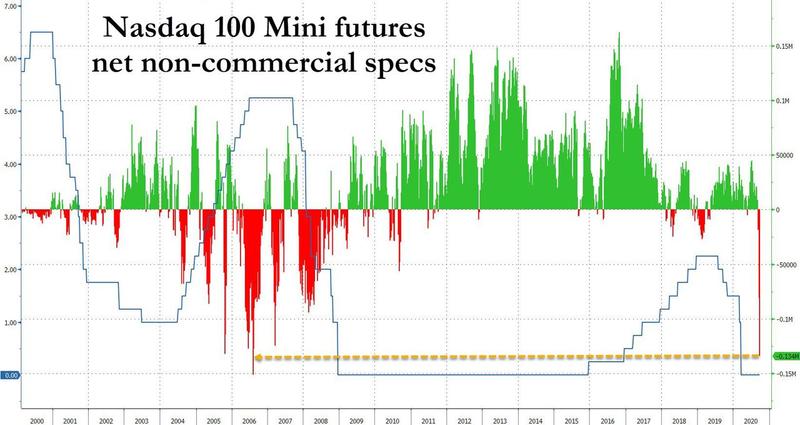

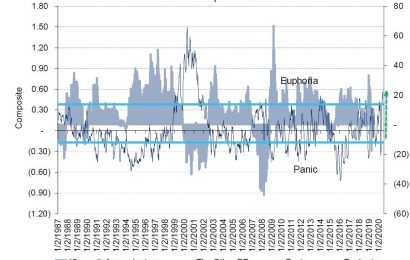

NASDAQ Shorts Hit Second Highest Ever

One week after one of the biggest inflows into stock funds on record – when retail traders furiously BTFD in hopes the market’s upward momentum would accelerate – speculators hit a brick wall and reversed furiously as stocks slumped, with...