As has been my standard since September 1998, I again publicly warn in advance of the increased risk of a decline in capital markets.

And now such a situation has come again.

What are the current reasons?

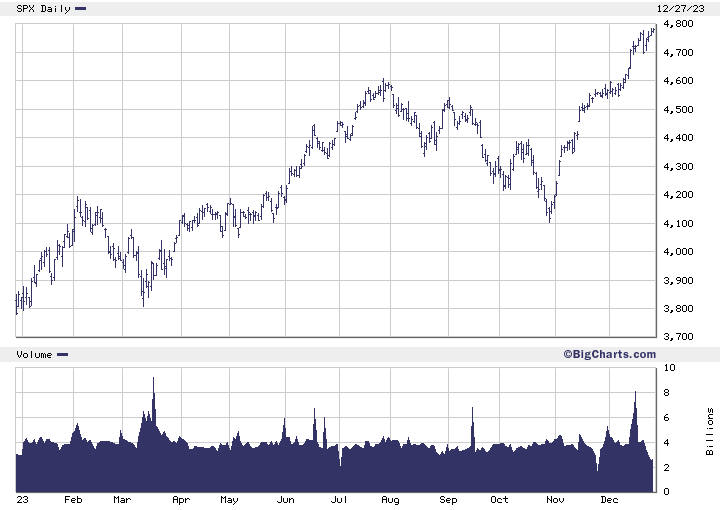

Goldman Sachs recently predicted S&P at 5,100 in 2024. This means a yield of 6.67% compared to yesterday’s value of S&P: 4,781. If, as an investor, you are satisfied with a yield of 6.67%, perhaps some bonds of low-risk issuers would be a less risky choice.

In other words: The probability of attractive returns is low compared to the high probability of another downturn in the capital market.

What is the current situation?

Pros:

- Overoptimistic analysts predict further growth in stock prices.

- Many companies, seeing no opportunity to meaningfully invest their cash, continue with generous buybacks.

Against:

- Generally, stocks are overpriced again.

- Valuation of shares not corresponding to what is to come.

- More and more companies and entire countries are avoiding the United States as an increasingly dangerous entity that supports an absurd occupation regime, that has been carrying out ethnic cleansing against the indigenous Semitic population with complete impunity for 75 years.

- There must be some reason why Warren Buffett’s Berkshire Hathaway is holding $157 billion in cash and waiting.

- Several thousand scientists and CEOs already know that a public presentation of a new technology (which will significantly influence the priorities of investors) is being prepared. And this launch will come in several phases during 2024.

In short: The chances of a few percent profit are small compared to the high probability of a larger decline in the capital markets.

I publicly and in advance pointed out the crashes of the capital markets in 1998, dot.com mania 2000, MBS scam 2008, pre-COVID everything bubble 2020, hype 2022 and correction in 2023.

And now that time has come again.