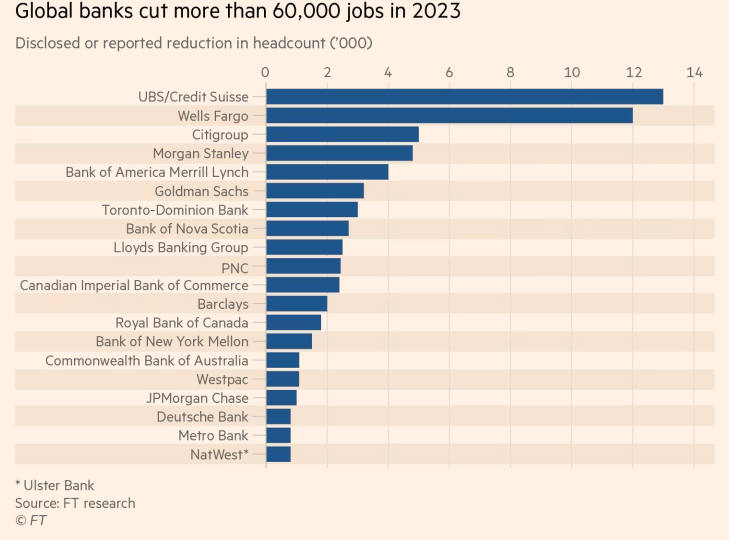

A new report from the Financial Times shows twenty of the world’s largest banks slashed 61,905 jobs in 2023, a move to protect profit margins in a period of high interest rates amid a slump in dealmaking and equity and debt sales. This compared with the 140,000 lost during the GFC of 2007-08.

FT noted that corporate disclosure data and its independent reporting did not include smaller regional bank cuts, indicating total job loss could be much higher.

At least half of the job cuts came from Wall Street lenders struggling with Western central banks’ most aggressive interest rate hikes in a generation.

The most significant cut of any single bank was at Switzerland’s UBS.

Morgan Stanley reduced jobs by 4,800, Bank of America by 4,000, Goldman Sachs by 3,200, and JPMorgan Chase by 1,000. As a whole, Wall Street cut 30,000 workers this year.

Gaurav Arora, global head of competitor analytics at Coalition, warned: “We expect full-year 2024 to be a continuation of the story of 2023.”

Arora’s view of further turmoil aligns with our two recent notes: Banks’ Usage Of The Fed’s Bailout Facility Soars To New Record High and Large Bank Deposits Rise As Money-Market Outflows Accelerate, Small Banks Still Stressed.

“We see banks getting more conservative,” Arora concluded.

Source: The Financial Times