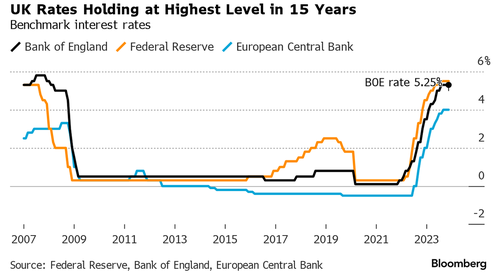

But rate-cut expectations are rising nevertheless. The Bank of England – as was expected – held interest rates steady at 5.25% (in a 6-3 vote – also expected, with Greene, Haskell, and Mann all pushing for another 25bps hike).

With rates at the highest level in 15 years, BoE governor Andrew Bailey warned there was “still some way to go” before inflation hit its target, with policy makers reiterating the need for rates to be kept high for an “extended period of time,” and leaving the door open the option of further rate rises if necessary.

“There is still some way to go. We’ll continue to watch the data closely, and take the decisions necessary to get inflation all the way back to 2 per cent,” Bailey said.

This persistent ‘higher for longer’ tone flies in the face of growing market bets on a wave of cuts in 2024 (in stark contrast with fresh signals from the Fed that US policymakers were preparing to ease rates next year), as BoE also cautioned that it is “too early to conclude that services price inflation and pay growth were on a firmly downward path.”

Chancellor of the Exchequer Jeremy Hunt said in a letter to Bailey that the bank continued to have his “full support” in its fight against inflation. The central bank said that Hunt’s Autumn Statement – which included a tax cut for workers and permanent full expensing for businesses – will boost the level of GDP by 0.25% over the coming years but also lift supply.

“We have turned a corner in our fight against inflation and real wages are rising, but we must keep driving inflation out of the economy to reach our 2% target,” Hunt said in a statement after the decision.

“By cutting taxes for hard working people and businesses, and helping people into work, we are forecast to deliver the largest boost to potential GDP on record.”

Source: BoE