Hedge Fund Flows Are All That Matter, New Study Finds. With every passing day, the bizarre central banks orchestrated freakshow that was once known as the “market” gets even more bizarre. And we use the term “market” in its loosest, legacy sense, one where it represented more than just the centrally-planned intentions of a few central banking academic and politicians. Why? Because as BofA’s CIO Michael Hartnett reminded us in in a recent Flow Show report, the disconnect between macro and markets has never been greater – i.e., they have never been more broken – but that is to be expected for the following three reasons:

- Markets rationally being “irrational”: government and corporate bonds have been fixed (“nationalized”) by central banks, so why would anyone expect markets to connect with macro, why should credit & stocks price rationally.

- Markets leading macro: policy makers (see China this week) know higher asset prices necessary condition for macro recovery (Wall St assets are 5.6x size of US GDP).

- Markets rationally pricing-in Max Liquidity, Minimal Growth backdrop, as they have done for 10 years; of 3042 stocks in MSCI ACWI currently 2141 >20% below their all-time highs, i.e. in a bear market.

So in this artificial, centrally-planned world where neither fundamentals, nor newsflow, nor data have an impact on “irrational” markets, does anything matter?

Well, yes, and it’s perhaps the one things analysts have been focusing on in recent weeks, namely smart money flows, of the kind discussed in “Hedge Funds Flood Into Stocks, Take Net Leverage Highest In Over Two Years”:

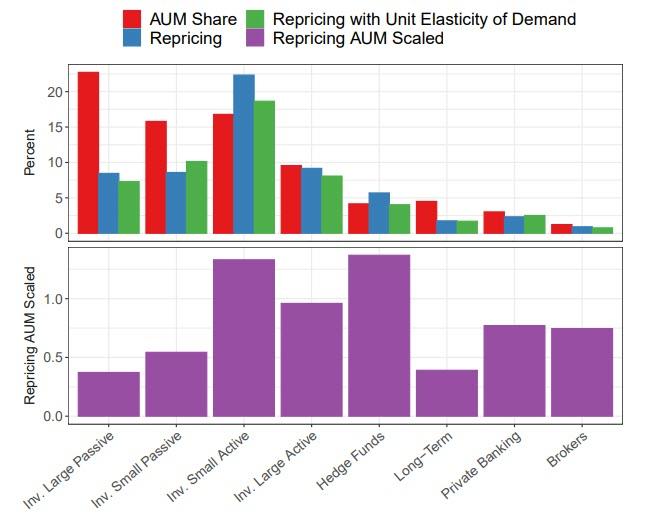

Well, as it turns out, our frequent obsession with fast money flows is actually justified: according to a recent research paper titled “Which Investors Matter for Equity Valuations and Expected Returns?”, hedge funds exert far more power on equity prices than most other classes of investors, while the passive cohort are among the least influential. The paper’s conclusion, as per Bloomberg: “The fast money has more than three times the impact on equity valuations, per dollar under management, than long-term investors like pension funds.”

It was not immediately clear where central bank fund flows rank in order of market impact priority although we would tend to guess toward the top.

“The influence of hedge funds is remarkable given their relatively small size,” the authors wrote. Smaller investment advisors had the second-greatest impact on price, and proved even more influential across a host of other characteristics, Koijen et al found.

“Small, active investment advisors are most important for the pricing of payout policy, cash flows, and the fraction of sales sold abroad,” they said.

The findings, as Bloomberg concludes, “provide ammo for stock allocators who front-run the buying and selling activity of their influential peers, in a world that can famously punish those trading on the basis of fundamentals.” It also suggests that contrary to growing speculation, passive investing vehicles such as ETFs have far less of an impact on market pricing. However, it’s only a matter of time before passive takes over the priority chain: having lured assets away from active vehicles for years, passive investing makes up an increasingly significant chunk of daily trading, “there are worries it could ultimately disrupt price discovery.” Oddly enough, there are no worries about central banks doing the same, even though the Fed and its peers have now made a total mockery of price discovery.

While the research didn’t speculate on the future, it did note that if hedge funds were to shift to a market index strategy, that would mean bigger price moves are needed to have any impact on a large passive portfolio.

“If these investors would hold a market-weighted strategy instead of their current strategy, the coefficient of valuation ratios on the fraction of sales that is exported would decline by more than 10%,” the trio wrote. “These investors therefore play an important role in determining the cost of capital of global firms.”