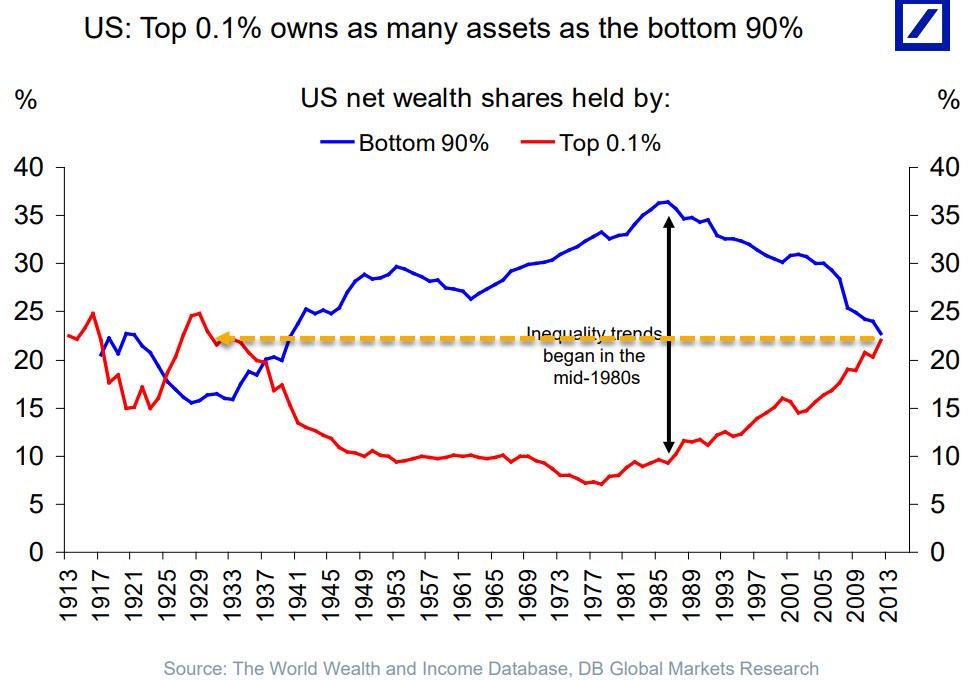

There is no more controversial entity in the US, more inflammatory yet out of the spotlight of public outrage, than the Federal Reserve: it is the FED’s actions over the past 108 years – and especially over the past decade – that have spawned much of the anger, resentment and hatred that has permeated US society to its very core as a result of the FED’s monetary policies.

Yet because much of the public fails to grasp the insidious implications of endless money-printing which makes owners of assets exorbitantly rich at the expense of regular workers, popular anger at the FED remains virtually non-existent, despite clear warnings from Thomas Jefferson, and countless others over the decades, about the dangers posed by central banking.

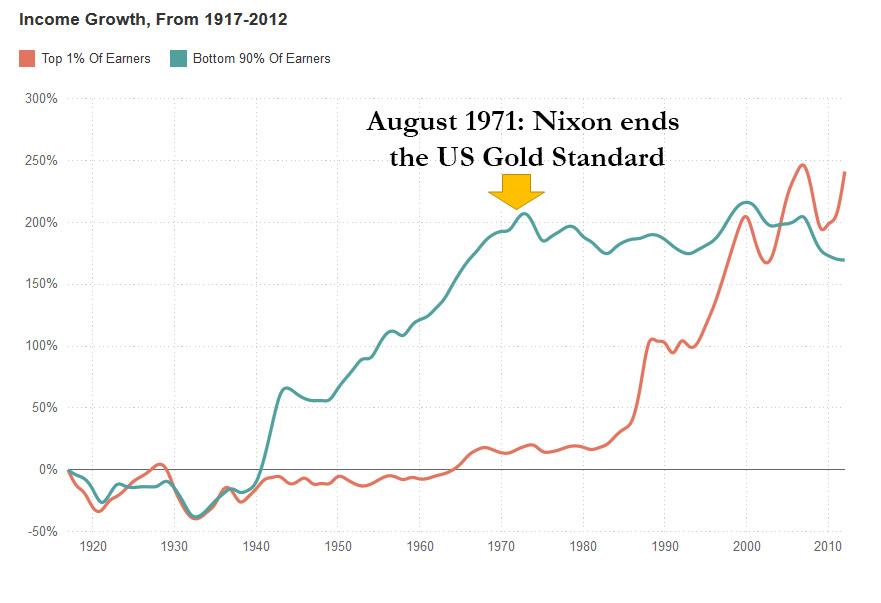

And so, taking advantage of the general public’s general gullibility, the FED continues to lie and dissemble at every opportunity, of which the most recent example was last week when Powell said that “inequality has been with us for increasingly for four decades” and arguing that monetary policy is not a cause for that. What he forgot to mention is that four decades ago is when the Nixon closed the gold window severing the last link of the US dollar to tangible value, and allowing the FED to print with impunity, creating the current wealth divide which has now spilled over into the streets of America.

Note: As state-of-the art analysts already know, to continue the gold standard, we would need 11 million golden spheres the size of planet Earth.

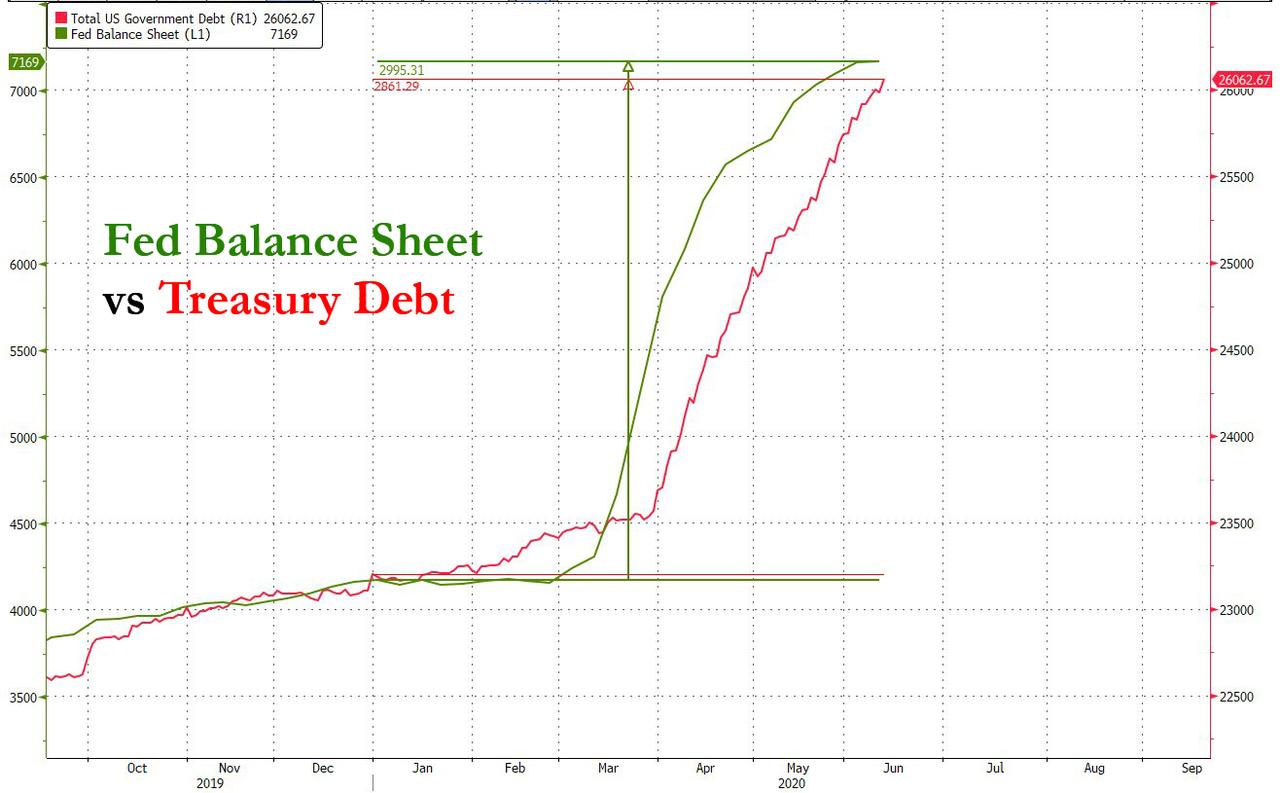

One other thing the FED has been consistently lying about is that it does not monetize the debt. The chart below is evidence that this, too, is a lie, with US Treasury debt increasing by $2.86 trillion in 2020 (most of it in the past three months) which is less than the $3.0 trillion increase in the FED’s balance sheet over the same period. In other words, the FED has monetized 105% of all Treasury issuance this year.

So although Powell may never admit it, Helicopter Money, also known as “MMT”, is now here, and will never go away as Deutsche Bank hinted earlier.

This will have ramifications that will last generations.

If this MMT school of thought continues to gain traction, then many of the investment playbooks from the last few decades need to be thrown out the window. It will be as a dramatic shift as the 1981-Paul-Volcker-stamping-out-of-inflation. It will be an end of an era.