Government Gives Every Adult Citizen HK$10,000.

Hong Kong just went full monetary-policy excitation.

In a desperate effort to “do something” about the economic collapse that the region is suffering. Hong Kong’s Financial Secretary Paul Chan Mo-po is set to unveil a HK120 billion relief deal which includes ‘helicopter money’ – giving every Hong Kong permanent resident over the age of 18 a cash handout of HK$10,000 (around US$1,300) to, reportedly, ease the burden on individuals and companies.

As SCMP reports, Chan has been under intense pressure from lawmakers to dose out a heavier aid to help the city ride out of the economic slump – battered by the coronavirus epidemic and months of anti-government protests, sparked by the now-withdrawn extradition bill.

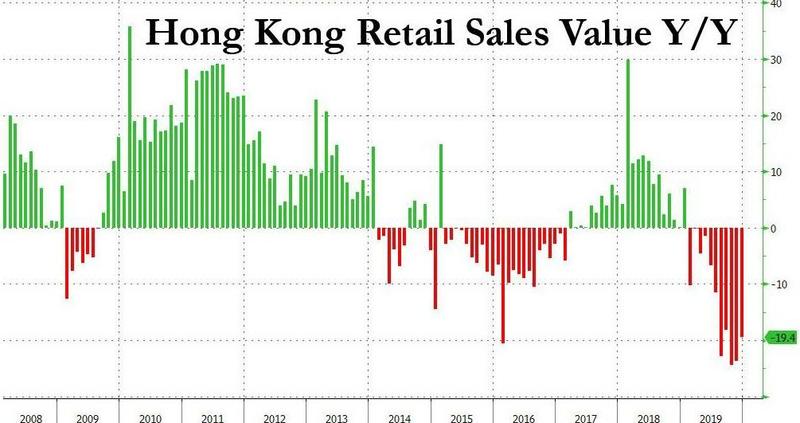

Hong Kong is suffering an unprecedented slump in consumption, with retail sales having collapsed.

Sun Hung Kai Properties, which is among Hong Kong’s largest mall owners, said on Wednesday it would reduce February rent by up to 50% for most of its tenants, in an effort to stabilize economy and protect employment.

Earlier this month, KPMG urged the Hong Kong government to unleash the helicopter money:

“The Hong Kong government should avoid the temptation to increase taxes or cut expenditures at a time when the city should in fact protect and even step up its domestic support programs,” said John Timpany, partner and head of tax in Hong Kong at KPMG China.

KPMG went on to propose a series of short and long-term spending measures, including:

- Giving out HK$10,000 electronic consumption vouchers to permanent residents age 18 and older to promote spending at local businesses.

- Tax relief measures for local businesses such as deferred payments and partial waivers of provisional tax.

- Extending rent subsidies for Hong Kong Science Park, Cyberport and other public institutions for six to 12 months.

- Support to working parents as well as allowance on rental expenses for residences.

- Boost Hong Kong’s long-term competitiveness by adopting bolder tax incentives and lower rates to attract overseas business.

“The reserves are meant to prepare Hong Kong for rainy days, and we should use it timely and wisely to weather the storm we are in now,” said Alice Leung, a partner for corporate tax advisory at KPMG China.

But, the money-drop was first suggested back in December, when the the pro-business Liberal Party proposed that the Hong Kong government should give cash or vouchers to each adult permanent resident in order to stimulate local consumption.

Last Friday, pan-democrats tabled a non-binding motion in Legco urging the government to include a HK$10,000 cash handout in its HK$30 billion aid package.

The motion was voted down by Chow and other pro-government lawmakers who said it would delay passage of the funding application for the package.

And as recently as Sunday, Chan said in a blog post:

“The government’s resources are finite, it is impossible for this budget to completely satisfy demands from everyone.”

But, it seems Chan was able to see past that ‘finite-ness’ and the virus scare was just the right crisis not to waste and will dip into the government’s large fiscal reserves of about HK$1.1 trillion to help the city ride out the economic slump.

The handout will cost HK$71 billion and benefit around 7 million people: