75 years ago this month, a group of 744 delegates from around the world gathered at the very posh Mount Washington Hotel in New Hampshire to build a brand new global financial system.

The year was 1944. World War II was still raging in Europe and the Pacific.

But with the successful invasion of Normandy well underway, the Allies knew that Hitler’s days were numbered. And they needed to start preparing for a post-war world.

Everyone knew the US would emerge from World War II as the the dominant superpower.

So the financial system they designed put the United States at the center of the world economy.

They called it the Bretton Woods system, named for the town in New Hampshire where they gathered.

And their central idea was that the value of the US dollar would be fixed to gold at a rate of $35 per troy ounce, while every other currency would be fixed to the US dollar.

The Swiss franc, for example, was fixed at a rate of 4.3 francs per US dollar, while the Danish krone was fixed at 4.8.

Bretton Woods ushered in a period of remarkable economic stability worldwide.

During the roughly quarter-century that the Bretton Woods system was in place, banking crises were almost nonexistent. Recessions were rare.

And global debt fell from nearly 150% of GDP at the end of World War II, to roughly 30% by the early 1970s.

Then it all came to a screeching halt in 1971.

The United States, weighed down by a costly war in Vietnam, suddenly and unilaterally terminated the agreement.

The US government wanted the flexibility to print as much money as it needed without being forced to maintain the gold standard.

So the whole system collapsed, practically overnight.

And it was replaced by a new standard where unelected central bankers have supreme authority to conjure near infinite quantities of money out of thin air.

The effects have been pretty disastrous.

Ever since the end of Bretton Woods, global debt has skyrocketed to roughly $200 TRILLION, approximately 225% of GDP.

Banking crises and financial shocks have become much more commonplace. Market crashes are more severe. Recessions are more common. Inflation worldwide has soared.

(It’s ironic that, back in 1944, the price of a room at the Mount Washington was $18. Today it’s over $250.)

Perhaps most of all, we now regularly witness some of the most extreme financial anomalies imaginable.

And one of the most obvious examples of this is negative interest rates.

In a number of countries, including Switzerland, Japan, Denmark, and the entire Eurozone, central bankers have printed so much money that interest rates are actually negative.

If you buy a TEN YEAR German government bond, for instance, your annual investment return will be NEGATIVE 0.27% per year, based on this morning’s rates.

That’s insane.

But just a few days ago the insanity reached a whole new level.

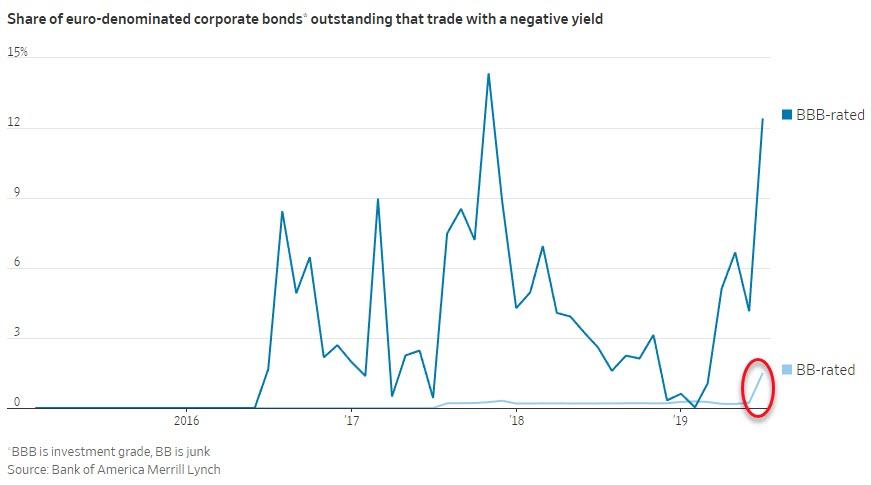

According to the Wall Street Journal, there are now some JUNK BONDS in Europe that have negative yields.

Think about this: a junk bond is basically debt issued by a company with financials so risky that analysts expect there’s a good chance the company won’t pay its debts.

Hell, the company might not even be in business by the time the debt matures.

And yet, despite these substantial risks, investors are willing to loan money to these companies… at NEGATIVE rates of return.

Seriously?? You take all that risk and then GUARANTEE that you’ll lose money.

Why do investors put up with it? Saturday’s Wall Street Journal offers a chilling explanation:

One euro junk bond from U.S. packaging company Ball Corp, for example, trades at a yield of minus 0.2% and matures in December 2020. That compares to a European deposit rate of minus 0.4% or a yield on a German government bond with a similar maturity of about minus 0.7%.

The choice for investors is about the balance between needing to stay invested and how much risk to take, according to Tim Winstone, a fixed-income portfolio manager at Janus Henderson. A bond like Ball Corp’s is “a safe place to hang out,” Mr. Winstone said. “And just because something is negative-yielding, that doesn’t mean it can’t get more negative-yielding.” Falling yields mean rising bond prices and gains for investors, at least on paper.

Many expect more bond yields to go negative as central banks in the U.S. and Europe cut interest rates or return to bond-buying to stimulate economies. In Europe especially, investors are realizing that negative interest rates are going to last a long time because the ECB needs to overshoot its inflation target to make up for the long spell when inflation has been far below 2%. Without a period of higher inflation, it won’t meet its target on average over the medium term.

The number of junk-rated companies with negative-yielding bonds will definitely go up, according to Barnaby Martin, credit strategist at Bank of America Merrill Lynch. “It doesn’t take much for it to go from 14 companies to 30 or 50 or 100,” he said.

In other words, as John Rubino recently noted, investors are now extrapolating falling interest rates into the future and playing junk bonds for the capital gains they’ll generate when their future borrowing costs go down. This is one of those sentiment shifts that financial historians will single out for special attention when sifting through the rubble of the coming crash.

Honestly I’m not a pessimistic person. But this sort of absurdity makes me pause and consider what might happen next.

The global economic expansion is one of the longest on record, ever. Financial markets around the world are soaring at all-time highs. Stocks. Bonds. Real Estate.

One of the only things we know for sure about financial markets is that they are ALWAYS cyclical. Up/Down, Boom/Bust. These cycles have been with us forever.

It’s impossible to predict exactly WHEN the decline will occur. But when you see JUNK bonds with NEGATIVE yields, it’s likely that we’re probably close to the end of the boom phase.

It’s possible this madness could continue for a while longer. Or it could end tomorrow.

No one has a crystal ball… but the important fact is to realize that at some point, this trend has got to correct.

All the trillions of dollars printed out of thin air to buy securities that yield negative interest rates will eventually have consequences.

That’s why I think makes sense to take sensible steps to protect yourself… no matter what happens next.