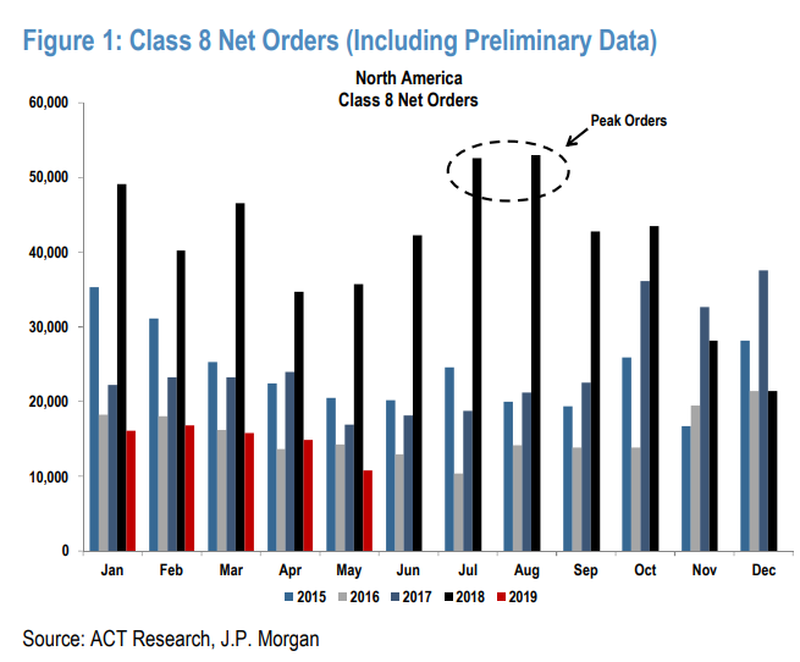

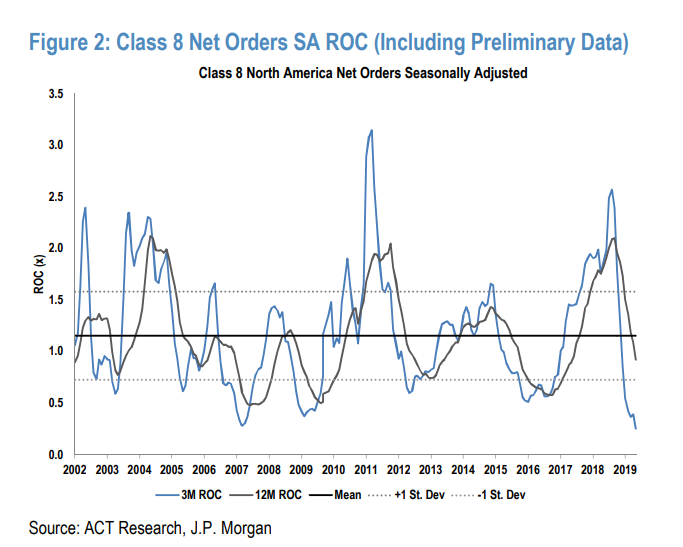

A bloated backlog of Class 8 orders as a result of a euphoric mid-2018 continues to weigh on heavy duty truck orders in 2019.

Preliminary North America Class 8 net order data from ACT Research shows that the industry booked just 10,800 units in May, down 27% sequentially, but also lower by an astonishing 70% year-over-year. YTD orders are down 64% compared to the first five months of 2018.

This chart shows the stunning difference between 2018 orders (black bars) and 2019 orders (red bars).

Class 8 trucks, which are made by Daimler (Freightliner, Western Star), Paccar (Peterbuilt, Kenworth), Navistar International, and Volvo Group (Mack Trucks, Volvo Trucks), are one of the more common heavy trucks on the road, used for transport, logistics and occasionally (some dump trucks) for industrial purposes. Typical 18 wheelers on the road are generally all Class 8 vehicles, and traditionally are seen as an accurate coincident indicator of trade and logistics trends in the economy.

In addition, a follow up note from JP Morgan noted that Class 5-7 (medium duty) net new orders were down 21% YoY and down 19% sequentially. For May, net orders were 19,300 units, down 21% YoY and down 19% MoM. Despite these trends, JP Morgan still expects 2019 production of ~278,000 units (up 2% YoY).

Kenny Vieth, ACT’s President and Senior Analyst said: “Fraying freight market and rate conditions along with a still-large Class 8 order backlog contributed to the worst NA Class 8 net order performance since July of 2016. May saw NA Class 8 orders fall below the 15,900 units averaged through the year’s first trimester, and year-to-date Class 8 net orders have contracted 64% compared to the first five months of 2018.”