Every time M1 growth has dipped negative – as central bank liquidity injection either slowed or went into reverse – there has been a financial crisis.

Milton Friedman was well aware of the consequences of the decline of M1, M2 and M3. His detailed analysis of the causes of the Great Depression is very convincing.

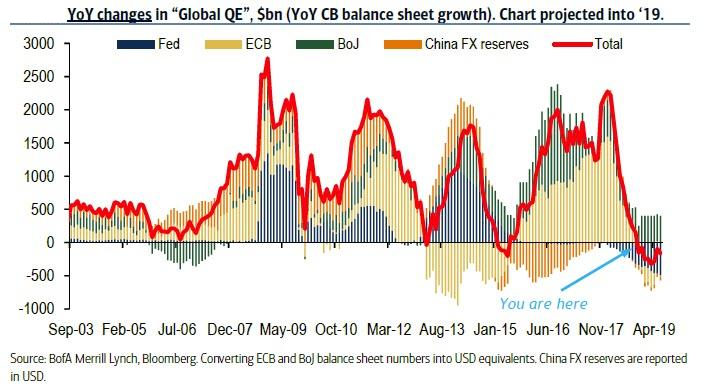

As the above BofA chart shows, global money supply has declined rapidly over the last year and a half. In fact, global money supply growth (using M1) is now flirting with the lows seen in mid-2008. And while some economies, such as China, are now pivoting back to supportive measures, BofA’s Barnaby Martin warns that high global debt will constrain economies’ enthusiasm for engaging in further rounds of stimulus. Meanwhile, as the chart below suggests, lower money supply growth has often pointed to weaker global economic momentum going forward. In fact, if one uses Global Industrial Production growth as a proxy for the global economic expansion, or contraction, the World is now almost certainly in a recession; the only question is when will economists acknowledge it.