Earlier this week analysts predicted Exxon will likely beat expectations largely thanks to surging plastic prices and that precisely what happened. As the company reported moments ago, while prices and margins for crude, nat gas and downstream were all in the 2010-2021 range, chemicals were a major outlier thanks to the sky-high price of petrochemicals.

What is also notable here is that while the vaccine rollout is helping improve global demand, this is being partially offset by persisting lockdowns and outbreaks, and as a result “Margins remain below 10-year lows driven by product oversupply and international jet demand.”

The company beat on the top and bottom line despite a continued slowdown in production. Here are the details:

- Q2 Revenue $67.74BN, beating Exp. $66.86BN

- Q2 Adj EPS $1.10 vs. Loss/Shr 70.0C Y/Y, and beating exp. of $0.99

- Q2 Capex $3.80B, beating exp. $3.31B, but looking ahead Exxon sees FY capex on the low end of its $16B to $19B guidance

The company reported price and margin improvements across all businesses with continued demand recovery; this however was offset by unfavorable mark-to-market impacts on open trading strategies with higher prices as well as higher planned maintenance across all businesses. On the other side, the company benefited from lower corporate and financing expenses and favorable tax items.

More details:

- Q2 Upstream Earnings $3.19B, Est. $3.05B

- Q2 Downstream Loss $227M, Est. Loss $155.6M

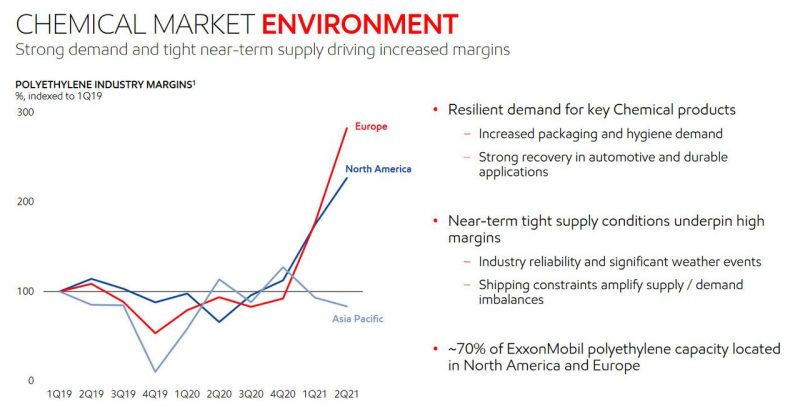

- Q2 Chemical Earnings $2.32B, Est. $1.94B

- Q2 Production 3,582 Mboe/D, Est. 3,683

Exxon said it cut Permian drilling and fracking costs by 40% while taking more than a third out its lease-operating expenses. The company hired hands of the oil patch have been on an efficiency tear over the past few years, able to do more for less. Explorers are able to get the same amount of output with less rigs compared to a few years ago. Additionally, due to growing activist pressure from the ESG army, the company said it achieved record-low flaring intensity in the Permian in the second quarter. Flaring intensity was down 30% compared with 2020.