After yesterday’s tech bonanza which saw Google surge, Apple fall and Microsoft swing when the 3 gigacaps reported more than $57 billion in net income, we now get the 4th FAAMG – Facebook – before Amazon closes the books on the 5 companies that account for more than 20% of the S&P’s market cap.

A quick look at sellside reports reveals that consensus expectations are for revenue of $27.86 billion for the quarter, which would be 49% growth (last year during this quarter, sales jumped just 11% given the advertising pullback surrounding the pandemic so there will be a sizable base effect). Analysts also expect user growth of around 7%, anticipating just under 2.9 billion monthly users for Facebook’s core social network. Facebook also reports a “Family” metric that encompasses users for all of its services. On that front, analysts expect 3.49 billion monthly users.

Some context: the ad industry is solid, with Twitter and Snap both reported strong second quarter earnings and Google ad sales rising 69% when it reported earnings yesterday. That explains why Facebook stock is already up 30% YTD.

So with that in mind here are Facebook’s Q2 results:

- Revenues $29.08BN, up 56% Y/Y, and beating exp. $27.86BN

- Advertising rev. $28.58 billion, +56% y/y, estimate $27.13 billion

- Other revenue $497 million

- EPS $3.61, beating exp. $3.02

- Daily Active Users 1.91B, Est. 1.91B

- Monthly Active Users 2.90B, Est $2.9BN

- Oper Margin 43%, Est. 37.6%

- Average Family service users per day 2.76 billion, +1.5% q/q, estimate 2.72 billion

- Average Family service users per month 3.51 billion, +1.7% q/q, estimate 3.49 billion

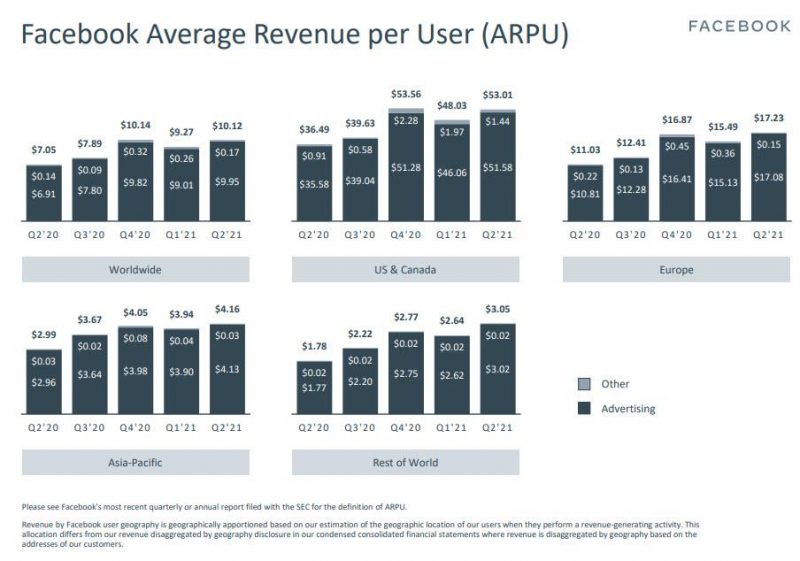

How did Facebook grow revenues by a whopping 56%? Yes, Facebook showed more ads than it did a year ago, but those ads were a lot more expensive on average, with a 47% increase in the average price per ad and a 6% increase in the number of ads delivered, while ARPUs also jumped from $7.05 to $10.12.

Some other details from the guidance:

- Expects 2021 Total Expenses to Be in Range of $70-73B

- Expects Year 2021 Tax Rate to Be in High-Teens

- Sees FY Capex $19B to $21B, Est. $20.14B

Also, as expected, Facebook said it continues to “expect increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recent iOS updates, which we expect to have a greater impact in the third quarter compared to the second quarter.”

As Bloomberg notes, the key question is whether what Facebook is seeing on the Apple tracking ban behind the scenes is worse than the company was already forecast? Hard to tell from the release. It says the impact will be greater than Q2, but not necessarily greater than the company was modeling.