With 9% of S&P 500 firms having already reported Q1 earnings including all of the major banks, results have generally disappointed relative to already tepid expectations. 43% of companies have missed consensus expectations, on pace for the highest rate since at least 1998 with earnings set to drop by 15% Y/Y, but it’s Q2 where the real pain will be with Goldman now expecting S&P 500 to plunge by a record 123% plunge.

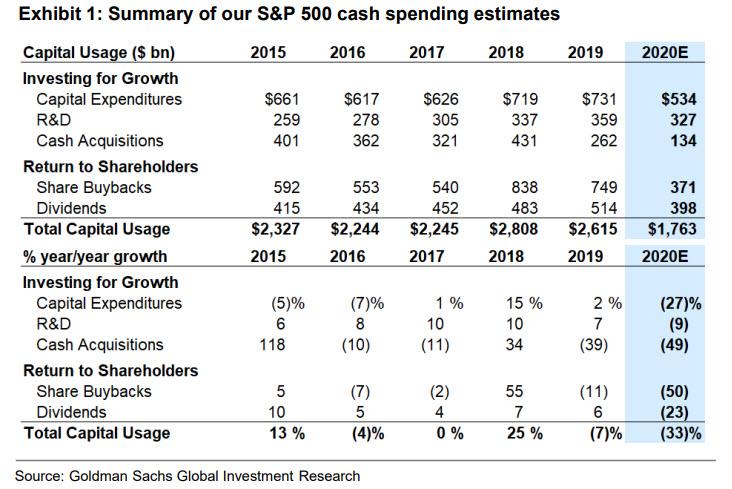

As a result, the very same Goldman Sachs which last week announced it no longer expects the S&P to retest the lows and pulled its S&P to 2,000 base case while predicting that stocks will surge to 3,000, which would make forward PE multiples just shy of a bizarro-world 30x, now forecasts S&P 500 cash spending will decline by an annual record 33% during 2020 as firms prioritize liquidity in a worsening economic environment.

Additionally, Goldman which late last year said that the US is now recession proof and predicted a surge in capital spending, now expects that Capex will decline by 27%, R&D by 9%, and cash acquisition spending by 49%, leading to a 26% plunge in investment for growth, which means a collapse of money in circulation besides that which is injected by the Fed and ends up going directly into risk assets, of course. And, as Goldman first predicted two weeks ago, the bank expects buybacks and dividends will also decline sharply in 2020, falling by 50% and 23%, respectively, which means that once the current CTA-driven rally fades as momentum suffers a “spectacular crash” in the words of Nomura.

Altogether, Goldman – which has flip-flopped so many times in the past month even the bank’s chief equity strategist David Kostin joked at his latest bullish reversal (See “Goldman Mocks The Absurdity Of Its Own “S&P To 3,000″ Forecast”) when he said “surprisingly, the largest shock to the global economy in 90 years has left equities only 18% below the record highs of mid-February and roughly in line with the market price in June 2019, just 10 months ago“, now expects aggregate S&P 500 cash usage will plummet by 33% – or $850 billion – to $1.8 trillion in 2020. Investment for growth (capex, R&D, and cash M&A) will fall by 26% to $1.0 trillion and account for 56% of total S&P 500 cash outlays. Buybacks and dividends will fall by a combined 39% to $770 billion and account for 44% of total spending.

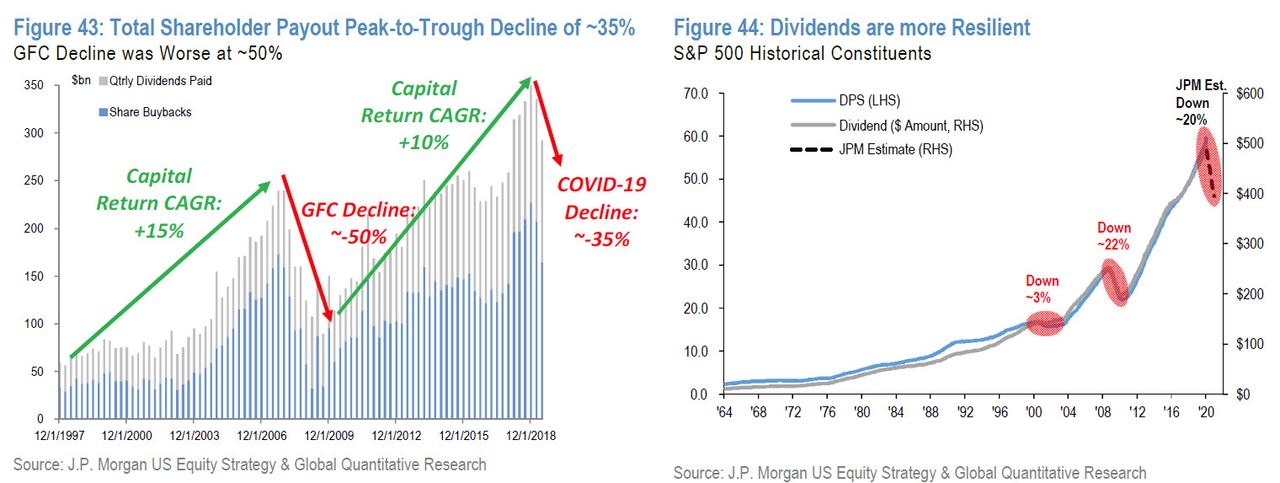

Incidentally JPMorgan is not too far behind, and now expects a 35% decline in shareholder payout, just shy of the 50% recorded during the GFC, with Dividends somewhat more resilient than buybacks.

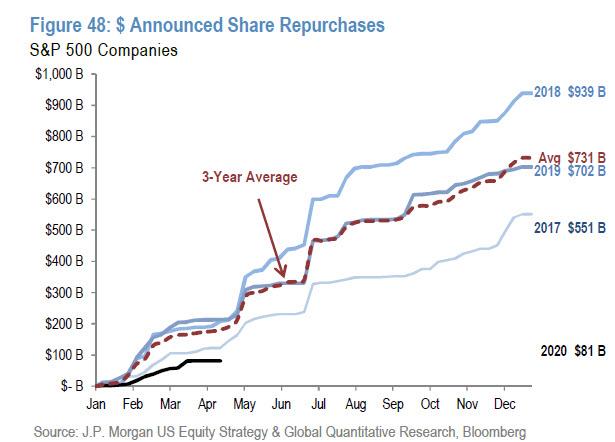

JPM’s forecast may prove quite optimistic, considering that announced buybacks YTD are running at just under the 3-year average.

Below is a breakdown of what Goldman expects will happen to the five key corporate uses of cash: capex, R&D, cash acquisitions, all of which are instrumental for growth, as well as a share buybacks and dividends, i.e., returns to shareholders.

- S&P 500 capex will fall by 27% to $534 billion during 2020. Sell-side analyst estimates revised during the past 45 days indicate S&P 500 capex likely fell by 5% year/year during 1Q. Goldman expects a 33% decline during the remaining three quarters will result in a 27% full-year drop. Capital expenditures fell by 23% from peak to trough during the Global Financial Crisis and 33% after the collapse of the Tech Bubble. Notably, the Energy sector accounted for one third of the index-level decline in capex after the financial crisis. In contrast, the sector accounted for just 15% of 2019 S&P 500 capex. In addition, Energy spending has declined 50% from its 2014 peak, further reducing the likely drag from Energy on total S&P 500 capex.

- R&D is comparatively less cyclical than capex and will fall by just 9% in 2020. Since 1990, research and development only experienced a peak-to-trough decline greater than 5% during 2009, when spending fell by 13%. In that experience, 80% of the index-level decline came from Consumer Discretionary and Health Care. Despite the COVID-related R&D spending boost, Healthcare R&D outlays during 2020 may be worse than many investors expect. Most S&P 500 biopharma firms are conducting research to find a vaccine for COVID-19, but data indicate new clinical trials for non-COVID treatments have fallen by 80% since early March. In addition, a significant portion of vaccine research is being shouldered by governments and NGOs rather than biopharma firms.

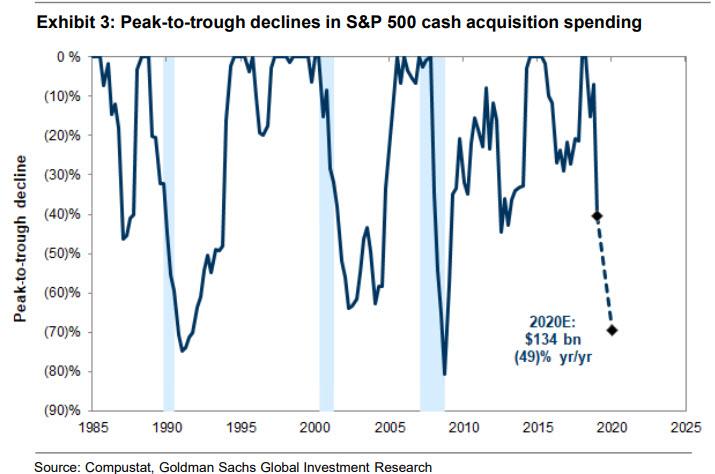

- Cash acquisition spending will fall by 49% due to a collapse in transaction volumes and a shift in consideration toward stock-based deals. Completed M&A volume with a strategic, US-based acquirer has fallen by 2% YTD compared to the year-ago period. However, the cash portion of these deals fell by 31% year/year. Announced volumes have collapsed by 56% YTD, with a similar decline in the cash portion of these deals. We believe continued weak announced M&A volumes, a light backlog of deals pending completion, and a shift in consideration away from cash as firms prioritize liquidity will contribute to a sharp decline in cash acquisitions during 2020. Cash M&A declined by 39% during 2019. Goldman’s forecast decline in 2020 cash M&A spending would result in a 70% peak-to-trough decline and is consistent with declines around the recession during the early 1990s (-75%), the collapse of the Tech Bubble (-64%), and the Global Financial Crisis (-81%). And since corporate CapEx is once of the biggest GDP drivers, this is yet another reason why the bulls can forget about a V-shaped recovery.

- Share repurchases will decline by 50% to $371 billion during 2020. Goldman’s review of S&P 500 earnings transcripts consistently reveals that management teams view buybacks as the lowest priority use of cash. Since the beginning of March, 58 S&P 500 companies accounting for 29% of total 2019 buybacks have suspended their repurchase programs. Mounting liquidity constraints and increasing political and social pressure will curtail buyback spending during 2020.

- Aggregate S&P 500 dividends will slide by 23% to $398 billion in 2020. S&P 500 dividends per share (DPS) rose by 9% in 1Q. However, since the start of 2Q, 21 firms accounting for 4% of overall DPS have cut or suspended their dividend. Dividend suspensions, cuts, and eliminations will result in S&P 500 DPS falling by 25% vs. 2019 levels, according to Goldman. For context, futures imply an 18% decline this year. The relationship between changes in S&P 500 DPS and aggregate dividends – which also includes cash preferred dividends – suggests total dividend spending will fall by 23% during 2020. In contrast, bottom-up analyst dividend expectations imply S&P 500 DPS will increase by 2% during 2020. This may be yet another reason why the market will suffer a spectacular second crash as soon as reality collides with sellside narrative fiction again.

That said, not all companies will slash dividends during 2020. In fact, this week JNJ and PG announced dividend hikes of 6.3% and 6.0%, respectively. To reflect the new reality, Goldman has rebalanced its dividend growth basket, which consists of the 50 S&P 500 stocks with the best combination of dividend yields and expected dividend growth; here each company has a payout ratio of less than 75%. There are 25 new constituents in the basket since it was rebalanced in Oct. 2019.

And here something curious: after investors rewarded the biggest trash companies, those with the worst and most levered balance sheets for most of the past decade, the market has shifted and investors instead have started to reward firms with safe balance sheets. Consistent with the YTD outperformance of strong balance sheets, debt reducers have outperformed debt issuers YTD, and Goldman’s Debt Reducers basket has outperformed a comparable basket of Debt Issuers by 8 pp YTD (-18% vs. -26%). The median stock in the basket of Debt Reducers paid down debt equal to 5% of enterprise value during the past 12 months vs. an increase of 5% for the median debt issuing stock and no change for the typical S&P 500 stock.

Then again, with the Fed now explicitly backstopping the riskiest of companies by buying their junk – literally – we fully expect that this brief return to investing sanity will quickly reverse, as algos and millennial traders reward the biggest junk they can find, sparking more short squeezes until everything crashes again and the Fed is forced to start buying stocks.