FED Is Monetizing 90% of U.S. Deficit to Keep Interest Rates from Rising and Crashing Markets.

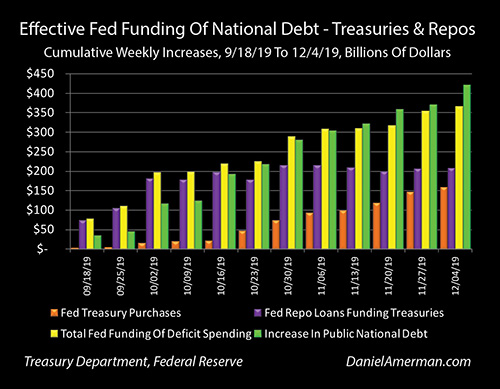

As can be clearly seen in the graph above, for the last 12 weeks there has been a stunning visual correlation between the yellow bars of the total weekly funding of deficits by the Federal Reserve, and the green bars of the weekly deficit spending by the United States government.

Total deficit spending, the extent to which monies spent by the federal government exceeded taxes collected, was a staggering $422 billion in just the last 12 weeks. In total, $367 billion of the funding for this increase in the national debt was provided at very low interest rates, via the mechanism of the Federal Reserve simply creating the money needed to fund the government spending.

Neither the Treasury Department nor the Federal Reserve will admit to what is happening. The Fed is using two separate programs to accomplish this, with a sufficient degree of complexity that it becomes difficult for average citizen to follow where the money is coming in from and what it is being used for.

In this step by step analysis, we will put together the week by week numbers from the Fed and the Treasury, uncover what is being hidden behind a veil of complexity, and show the simple truth – about 90% of recent federal government deficit spending has effectively been funded at below market rates by simply creating the new money.

Deficit Spending Has To Be Funded By Somebody

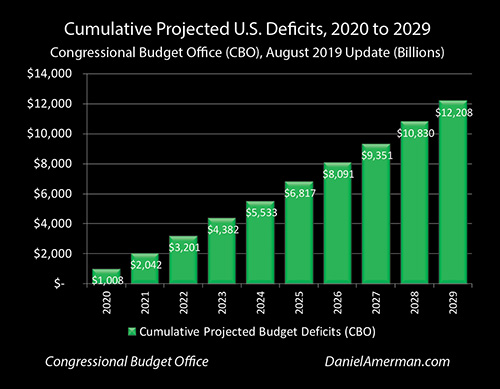

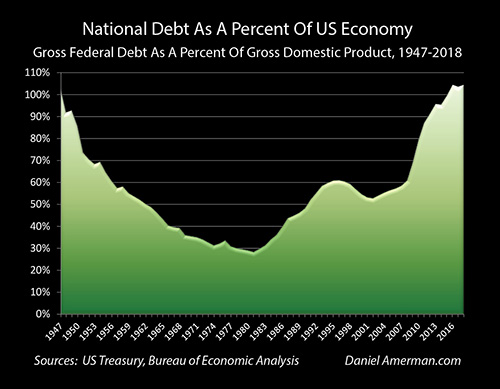

As 2019 ends, we are in a time of potentially rapid change for markets, interest rates, investment prices and the funding for the national debt. As reviewed in recent analyses, we have moved back into a time of $1+ trillion annual deficits, and this is currently projected by the government to extend into the indefinite future.

The Congressional Budget Office is projecting over $12 trillion in deficits over the next ten years, and for the average person that is such an astoundingly large number that it may sound quite theoretical. What needs to be understood about deficits, is that they are not the slightest bit theoretical.

The government spends massive sums of money. What it doesn’t take in from taxes it has to borrow. Every one of those 12+ trillion dollars shown above has to exist – it will be spent. At the time it is spent, it will be every bit as real as the dollars in your checking account or money market account. And those real dollars for new spending have to come in from somebody. (Funding new deficits each week and each year is a very concrete process that is much more dangerous than looking just at the $23 trillion total of the national debt, even if most people are not aware of this.)

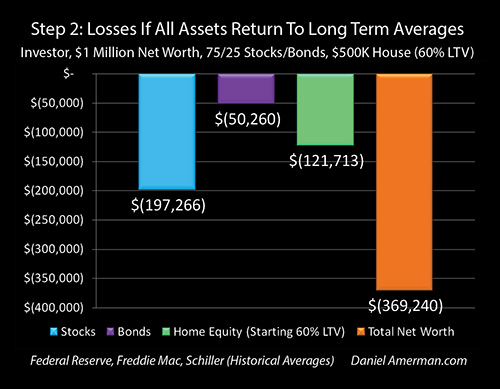

This money has to be there, and it has to be available at abnormally low interest rates, or as reviewed in previous chapters, market stability is imperiled along with the values of the nation’s retirement accounts and homes.

Beginning in October of 2019, the Federal Reserve made an abrupt turn, and for emergency reasons began using monetary creation to get the money to buy $60 billion per month in U.S. Treasury obligations, as explored in much more detail in Chapter 18

The Federal Reserve does not directly purchase those Treasury obligations from the U.S. Treasury Department itself, nor does it issue press releases talking about how it is creating new money to finance deficit spending and the growth of the U.S. national debt.

But effectively – that is exactly what it is doing. The Fed is creating new money, and using it to buy massive amounts of government obligations at very low interest rates, so that the U.S. government does not need to raise the money from private parties (like it is supposed to), who might require higher interest rates. Now that this astonishing program has been running for going on two months, it is worth taking a look at what has been happening in practice.

As can be seen in the graph above, the orange columns represent the net increase in Treasury obligations owned by the Federal Reserve in each week, and the green columns represent the increase in the public portion of the U.S. national debt in that same week.

As is visually obvious – there is a very strong relationship between the Treasury getting new money each week to finance government spending that is over and above what taxes pay for, and the Federal Reserve creating new money each week to finance a big chunk of that extra spending.

The first week when this process really got going was that ending on October 23rd. The Fed purchased $26 billion in new Treasuries (through the markets), and the Treasury sold $26 billion in new debt. Since neither the Federal Reserve or the Treasury Department openly admits what is happening here – that is quite the amazing coincidence, isn’t it?

Of course, $60 billion a month in Treasuries purchased with created money is not enough to fund a $1+ trillion per year deficit, so over the following weeks we see a partial funding. By the week ending on November 13th, the Federal Reserve had purchased about $78 billion in new Treasuries, and the Treasury Department had issued about $129 billion in new debt.

When we look at the cumulative total through December 4th of 2019, the Federal Reserve created $137 billion in new money and (effectively if not openly) used that to finance deficit spending. This compares to the Treasury spending $229 billion more than it took in. So, the Fed didn’t finance everything (through this first program) – but the Treasury did on an effective basis, only have to find $92 billion in outside money to fund government spending, instead of the $229 billion it would have otherwise had to raise, while potentially paying higher interest rates to get that money.

The Role Of Repos In Funding The National Debt

The other major source of Federal Reserve funding for the government is via “repo” lending, and this source is much less understood – but every bit as important as the purchase program. The “repo” or repurchase agreement market is not something that most individuals are familiar with – but it underpins the U.S. financial system, and is an extremely important source of cash for many banks and institutional borrowers. It is also an important source of funding for the national debt.

A repurchase agreement is essentially a secured loan, that is legally a sale. Collateral – generally U.S. Treasury obligations – is sold to a buyer (who is effectively a lender, and is the Federal Reserve in this case). There is a simultaneous agreement at the time of the sale to repurchase the collateral at an agreed upon price and time, which is usually the next day. The difference in price between the sale price and the contractual repurchase price is effectively the repo rate of interest.

The Fed does not usually lend via the repurchase agreement market, and had not done so on a significant scale since the 2008 financial crisis. However, there was a crisis in the repo market in the week of September 16th, 2019, which led to major Federal Reserve interventions, which have continued through December. Crucially and as covered in much more detail in Chapter 18, the Federal Reserve itself says that the source of the repo crisis was when the U.S. government tried to pull too much money out of the system in one week, both via corporate taxes and new deficit borrowing. Below is a direct quote from Fed chair Powell on September 18th, as the crisis was developing:

“…pressure emerged as funds flowed from the private sector to the Treasury to meet corporate tax payments and settle purchases of Treasury securities. To counter these pressures, we conducted overnight repurchase operations yesterday and again today.”

How did the Fed deal with a market crisis caused by the government trying to pull too much cash out at one time for taxes and deficits? By creating the money to fund the cash shortfall on an emergency basis. That is a very direct connection that continued and grew from there forward, even if it has not gotten anywhere near the attention it deserves.

Now, it is accurate to say there that are multiple sources of the turmoil in the repo market, with some of them being closely tied to year end banking reserve requirements or hedge fund activity – but it is equally accurate to say that the Fed creating money to fund repo loans accomplishes multiple goals.

The first level of understanding is that when the Fed lends via the repurchase agreement market – it is quite literally buying and paying for the U.S. Treasury collateral. So, when the Fed funds $200 billion in repurchase agreements, it owns another $200 billion in U.S. Treasury obligations. The borrower enters into a legal agreement to repurchase, usually the next day, but in the meantime the Federal Reserve owns the Treasuries. Because these repos are usually rolled over every day, that means that the Fed owns the Treasuries each day.

The next level is to look at repos in the way that they are generally treated for accounting and regulatory purposes, which is as a lending market. To access this market, the starting point is for the repo borrower to have the U.S. Treasury obligations to serve as collateral. This ownership is effectively paid for on a daily basis as the loan rolls over, by the repo lender. So, when the Fed creates $200 billion in new money to extend $200 billion in new loans, that are collateralized by $200 billion in Treasury obligations – the Fed is effectively funding those Treasury obligations via the new money.

Now, let’s look at on both levels. Legally, the Federal Reserve owns the U.S. Treasury obligations, it created the money to buy them, and the repurchase agreement is the obligation by the seller to buy them back. In practice, repos are loans that are funded by the Fed, using created money, and the Fed is fully funding the Treasury obligations. Either way – the Fed funds the deficits with created money, it is doing this on an emergency basis specifically because of the rate of government spending, but it is doing so behind a veil of complexity, in a market that most people have never heard of and that can only be understood with the use of a specialized vocabulary – so the public has no idea what is happening.

In total, the repurchase agreement market provides a substantial portion of the domestic private funding for the growth in the national debt, and this is not an accident. The U.S. government has created a regulatory framework where the repo market is cheaper and easier to access when U.S. Treasuries are used as the collateral, and this then provides an ongoing source of low cost funding for the national debt and the annual deficits.

There is another crucial layer as well, which is that the repo market effectively competes with other markets for the dollars of investors seeking very short term, very high quality places to invest money. Two of the biggest alternatives are the U.S. Treasury obligations and fed funds markets.

So, if repo rates move up on a sustained basis – then money is pulled out of the Treasury and fed funds markets, until those rates move up as well (all else being equal).

While little understood by the general public, the massive repurchase agreement market and the ability to use U.S. Treasuries as collateral to reliably obtain very low cost loans is not just crucial for financial stability, but is also an important component of the funding of the national debt, while being an important influence on the borrowing rate paid by the U.S. government.