Emerging Markets After $18 Trillion Global Equity Wipeout

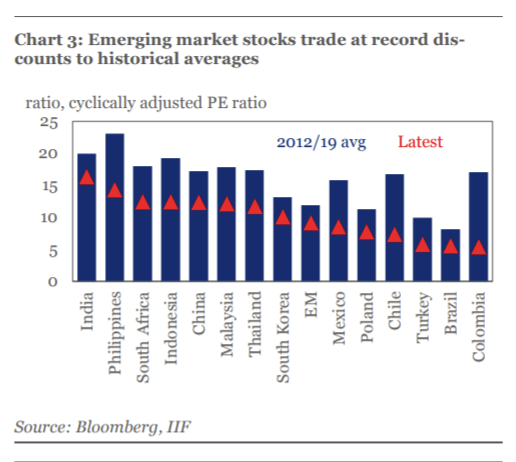

Emerging market stocks trade at record 65% discount to U.S. after $18 trillion global equity wipeout. The global financial rout triggered by the pandemic wiped $18 trillion off global equity markets in the year to date, and emerging markets, in...